Amazon Q4 2022 Earnings Call Summary

Navigating Uncertainty: Amazon's Focus on Cost Management and Customer Satisfaction

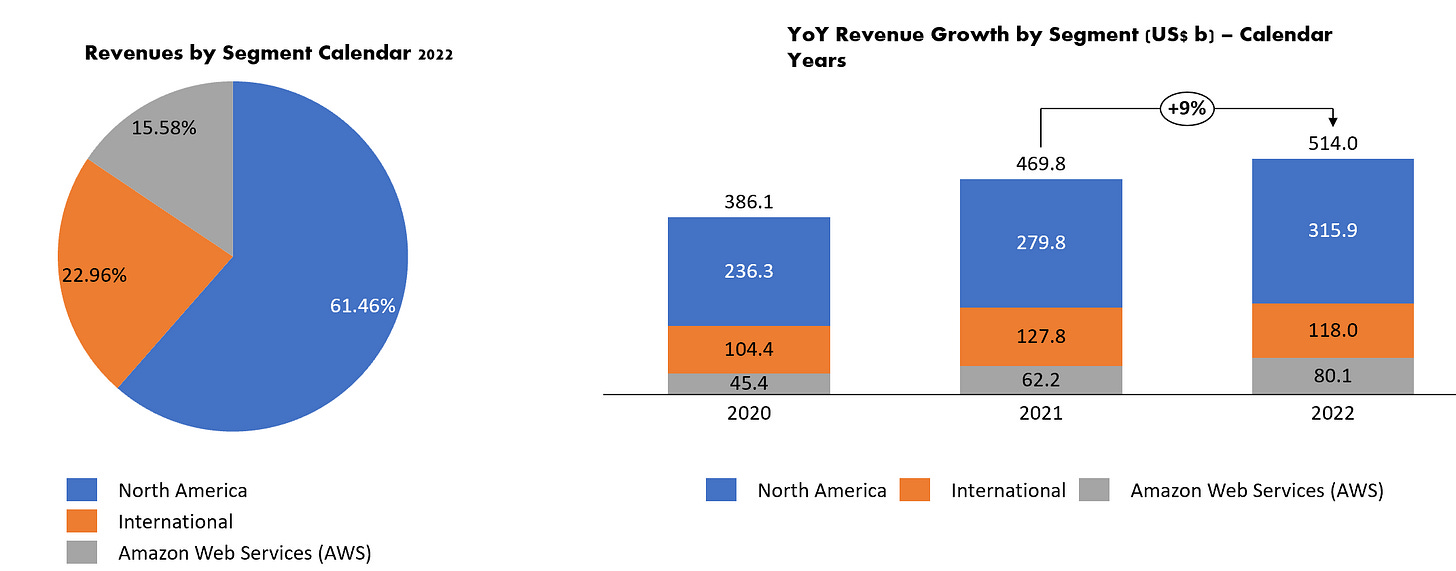

This article discusses the Q4 financial results of Amazon, including its retail, AWS, and Prime businesses. The net sales of AWS increased 20% YoY, while Prime membership remains strong with increased spending per member. The North American team's priority is to reduce costs, while AWS growth rate is uncertain due to the current economic conditions. Amazon's CEO, Andy Jassy, emphasizes the company's focus on improving the customer experience through innovation and expanding its global footprint.

General Intro

During economic uncertainty, consumers are careful about spending and Amazon's focus on the customer sets it apart

During the holiday season, customers came to Amazon for deals, fast delivery, and a wide selection from 2 million third-party seller partners

Customers remained cautious about spending and shifted to lower-priced items and value brands in electronics and continued to spend on essentials

Financial Results

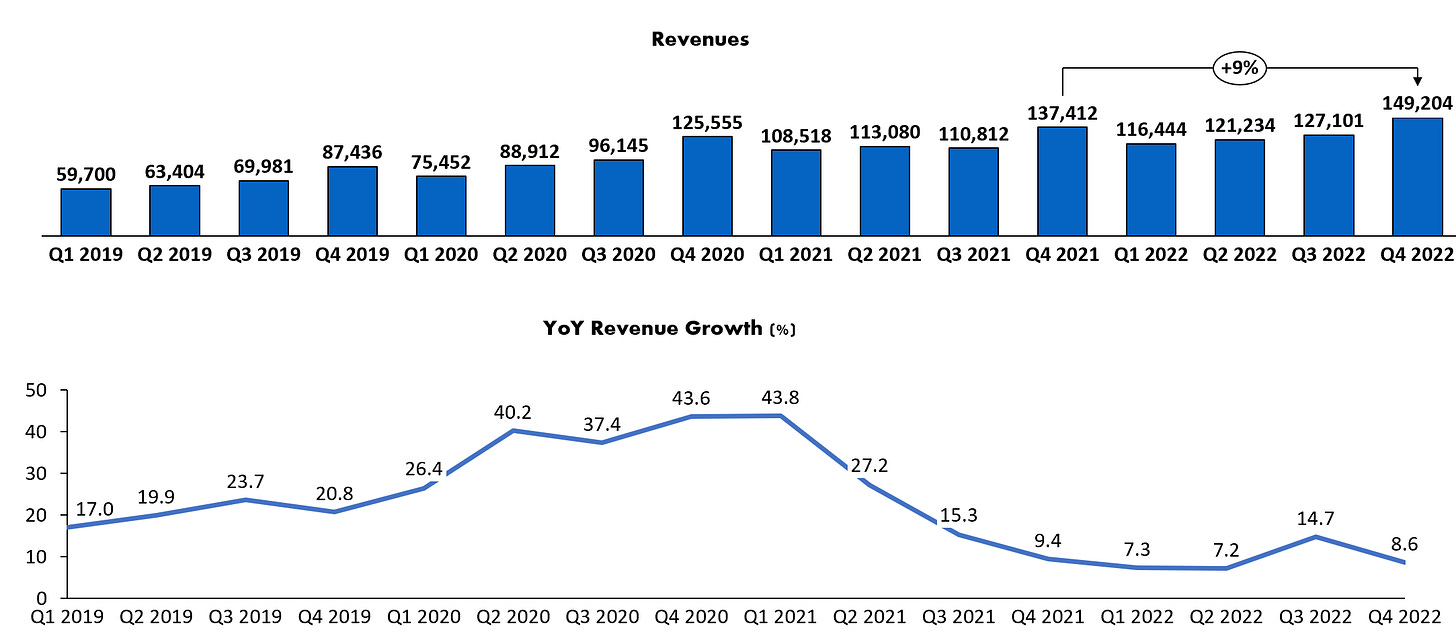

Q4 worldwide net sales were $149.2 billion, a 12% YoY increase, excluding the impact of foreign exchange rates

59% of unit sales in Q4 were from third-party sellers using Amazon's advertising capabilities

Ad revenues in Q4 increased 23% YoY, excluding the impact of foreign exchange

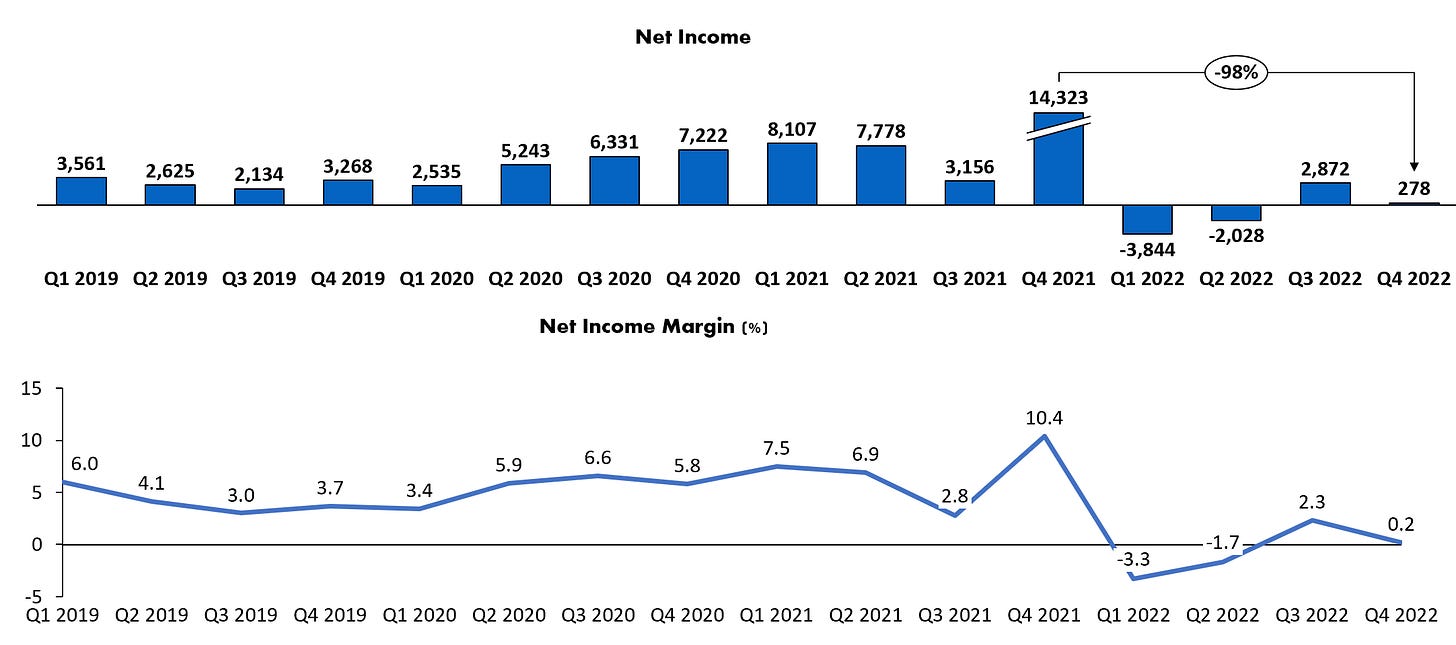

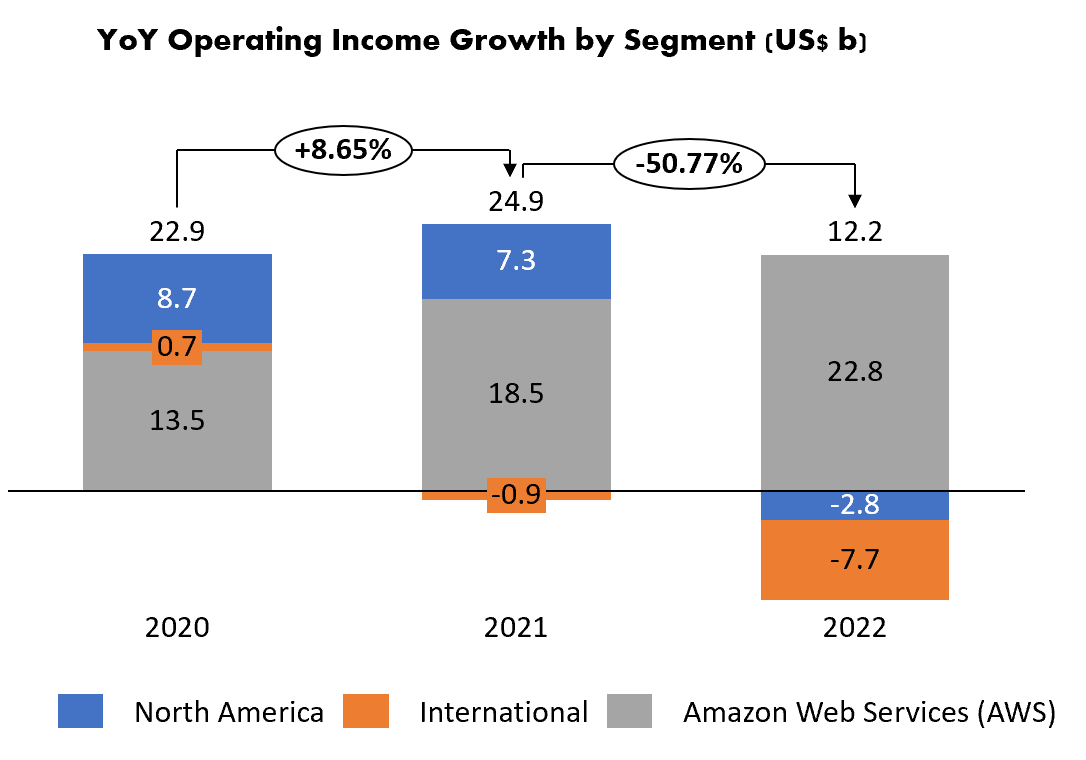

Worldwide operating income for Q4 was $2.7 billion, negatively impacted by $2.7 billion in costs related to employee severance, property and equipment impairments, and changes in self-insurance liabilities

Cost streamlining in the Amazon stores business is progressing, with labor better matched to demand in Q4.

Eric Sheridan of Goldman Sachs asks Brian Olsavsky to clarify what was captured in Q1 operating income guidance with regards to restructuring charges.

Brian explains that the $640 million charge related to position elimination in Q4 was captured in Q1.

The second question asked during the call was about the margin potential of the North America retail business over the next few years and the efficiency factors that will help reach these goals.

Brian Olsavsky addressed the second question by talking about the expectation for retail margins in North America and how it has changed over the last three years due to the doubling of the network expansion.

Brian states that Amazon is also questioning its infrastructure expenses

AWS

Enterprise customers continued to move to the cloud and work with AWS to reduce costs

Net sales of AWS increased $21.4 billion in Q4, a 20% YoY increase, now with an annualized sales run rate of over $85 billion

Enterprises optimized their cloud spending in Q4, causing growth rates to slow

AWS growth expected to continue to be a headwind for at least a couple of quarters with growth in the mid-teens so far in the first month of the year

Justin Post of Bank of America asks Andy about the revenue growth of mid-teens in AWS.

Justin also asks when the growth could recover and if margins would come back with reaccelerated revenue.

Brian explains the customers are looking to cut costs due to an economic downturn.

There is a decrease in some industries such as financial services and advertising, but the customers are working to cut costs across all industries.

Customers are reducing spend by switching to lower-cost products, running calculations less frequently, or using different types of data storage.

AWS growth rate for the next few quarters is uncertain due to the current economic conditions.

AWS will continue to be there for customers and work to secure new deals and workloads.

Leadership teams priorities change based on the current events and circumstances.

Retail

Jassy stated that the #1 priority for the North American stores team is to reduce the cost to serve in their operations network.

Jassy talked about the challenges of optimizing and making the fulfillment center and transportation network more efficient and productive.

Jassy also spoke about the importance of speed and getting products to customers faster to increase customer satisfaction and conversion rates.

Selection and having a wide range of products available will also always be a high priority for Amazon.

Jassy emphasized the importance of pricing, particularly in uncertain economic conditions where customers are more conscious of their spending.

Jassy talked about Amazon's focus on developing new technologies and capabilities that can improve the customer experience.

Jassy also spoke about Amazon's focus on expanding its footprint in new geographies and increasing its customer base.

Jassy stated that Amazon is always looking for new and innovative ways to improve the customer experience and make their lives easier and better.

Eric Sheridan of Goldman Sachs asks Andy Jassy about Amazon's global e-commerce footprint.

Andy is enthusiastic about Amazon's international e-commerce businesses, citing growth in the UK, Germany, and Japan.

Amazon has grown large enough in its developed international territories that it is impacted by significant macro events.

Andy believes the emerging countries (India, Brazil, the Middle East, Africa, Turkey, Mexico, and Australia) are on the right trajectory.

Prime

Prime membership continues to be a great value and improving Prime benefits is a continuous investment strategy

The first season of "The Lord of the Rings: The Rings of Power" was watched by over 100 million viewers and drove Prime sign-ups

Thursday Night Football was a success with a young median age audience and 11% growth in viewership

$7 billion was invested in digital video content in 2022, up from $5 billion in 2021

Prime membership remains strong, with increased dollars spent per Prime member.

Prime membership was boosted by the launch of Thursday Night Football and Lord of the Rings: Rings of Power.

Amazon is working on increasing speed of delivery for Prime members.

Prime offers value through entertainment content, fast shipping, music, gaming, photos, and other benefits.

Amazon will continue to add features to Prime.

Amazon is optimistic about Prime members spending more across all of Amazon's businesses.

Key Takeaways from what was said on the Call:

During economic uncertainty, consumers are cautious about spending and Amazon's customer-centric approach sets it apart.

During the holiday season, Amazon attracted customers with deals, fast delivery, and a wide selection of products from 2 million third-party sellers.

Q4 worldwide net sales were $149.2 billion, a 12% YoY increase. 59% of unit sales were from third-party sellers.

AWS continues to attract enterprise customers moving to the cloud and reducing costs. AWS had a net sales increase of $21.4 billion in Q4, a 20% YoY increase.

The North American stores team's priority is to reduce costs and improve the customer experience through efficiency, speed, selection, and technology.

Prime membership remains strong, with increased dollars spent per member, boosted by entertainment content and new features.