Blink Q4 2022 Earnings Call Summary

Blink Charging - Meeting Global EV Charging Needs and Exploring New Monetization Opportunities.

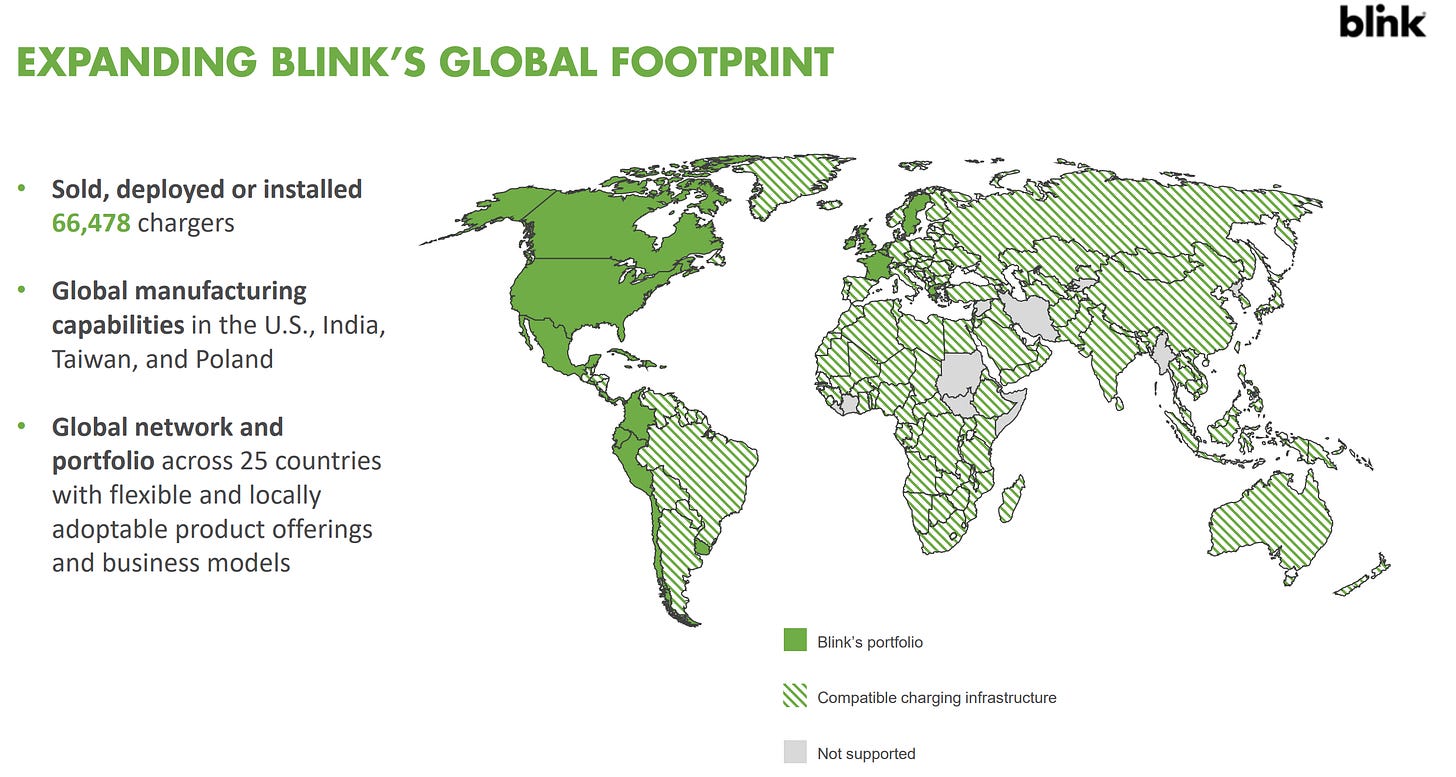

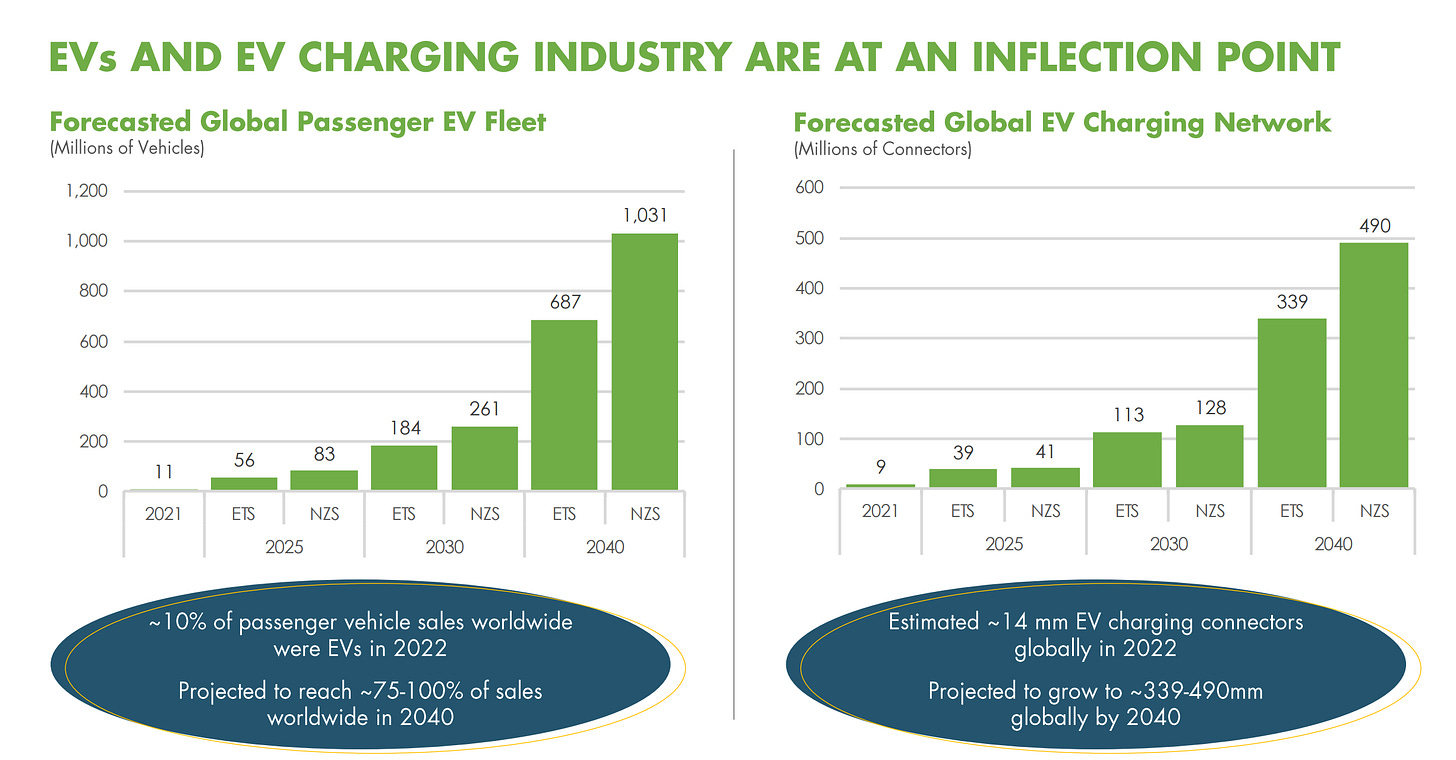

Global EV sales grew by 68% YoY in 2022, reaching around 10% market share for the first time. This shift towards electric vehicles requires the installation of new infrastructure, including charging stations. Bloomberg predicts that by 2040, we will need up to 490 million chargers globally to meet demand. Blink, the only fully vertically integrated charging company in the US, provides a wide range of products and services, including residential L2 chargers and high-powered DC fast chargers. Blink's services cover both residential and commercial locations, and they have identified Southeast Asia as their primary target market. As the demand for EVs continues to rise, Blink is committed to providing the necessary charging infrastructure to support this shift towards a cleaner and more sustainable future.

Industry trends and growth potential

Global EV sales grew by 68% YoY in 2022, with EVs achieving around 10% market share for the first time.

Many OEMs are going electric with their mainstream offerings and making them more affordable to achieve scale, which will ultimately lead to price parity with internal combustion engines.

The shift to electric vehicles will not only change the needs for refueling but also put in place the need for new infrastructure required to service and maintain these vehicles.

Bloomberg predicts that by 2040, we'll need anywhere between 340 million to 490 million chargers globally to meet demand, and we're not even close at about 14 million chargers.

Blink's business and financial performance

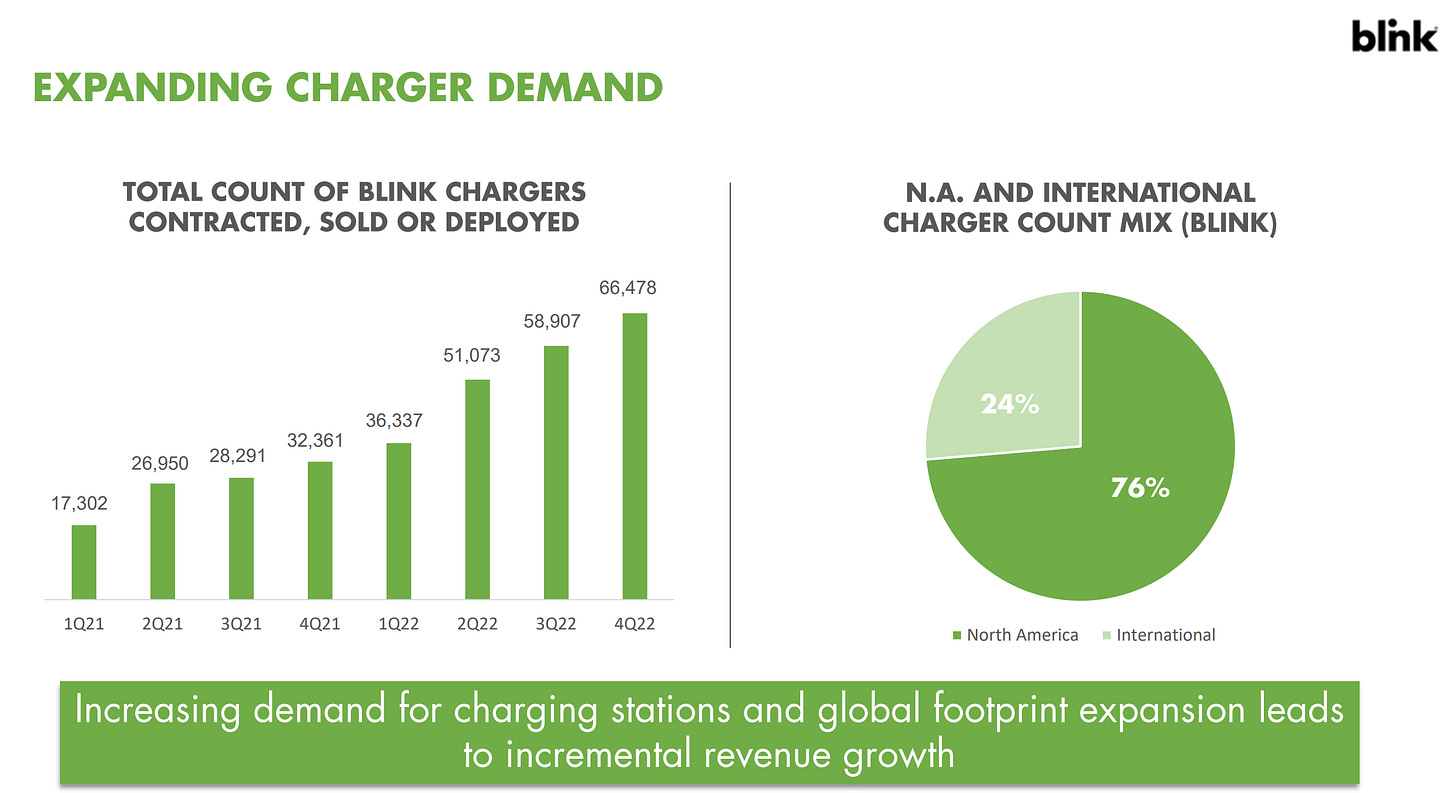

Blink increased revenue by almost threefold in 2022 compared to 2021, and service revenue grew by 213% in Q4 '22 compared to Q4 '21.

Blink's number of stations contracted, sold, or deployed grew to 66,478 units, an increase of 105% compared to the prior year.

Blink is the only fully vertically integrated charging company in the United States and among only a few vertically integrated charging providers globally.

Blink has a variety of ownership models ranging from network subscription to host-owned, hybrid or Blink-owned and operated, and is intensely focused on delivering excellent products and services with an unparalleled customer experience.

Blink acquired Blue Corner, Electric Blue, and SemaConnect in 2021 and 2022, which reflected the strength of adding these complementary businesses to the Blink family.

Blink closed an oversubscribed registered public offering of common stock for gross proceeds of approximately $100 million in February 2023.

Blink's products and services

Blink has a wide variety of products, ranging from residential L2 chargers to high-powered DC fast chargers, as well as newly unveiled products such as Vision IQ 200.

Blink services both residential and commercial locations, including an increasing number of fleets across the United States.

Blink carries a wide variety of DC fast charging offerings to meet customer specifications, providing anywhere from 30-kilowatt chargers to 350 kilowatt and above power.

Blink's products are designed for different DC installation settings that vary around the world, and the company offers flexible DC solutions and ownership models.

Southeast Asia EV Market

Southeast Asia is the primary target market for Blink's charger.

EV adoption for 2-wheel and 3-wheel vehicles in Southeast Asia is expected to be 40% to 45% by 2030.

13 million to 14 million of these vehicles will require flexible charging infrastructure.

Products and Services

Blink has a variety of products to meet charging requirements globally.

The PQ 150, or energy kick, is a smart charging cable for residential charging in European markets and is ideal for reimbursement of charging costs for fleet vehicles at home.

The Blink Network and Blink Charging Mobile App have been completely redesigned and launched in 2022.

The Blink mobile app allows EV drivers to search for nearby amenities and chargers, save favorite charger locations, and manage payment information.

Site hosts have expanded functionality and can manage their business in multiple languages across 25 countries.

Government Initiatives and Market Growth

In the US, the administration has committed to building a nationwide network of 5,000 chargers.

The goal is for 50% of all new vehicle sales in the US to be EVs by 2030.

Blink is compliant with Buy American requirements and plans to produce 100,000 units annually in the US.

Market growth is supported by government initiatives.

Synergies and Financial Results

Blink has identified $27.7 million in synergies related to SemaConnect.

$5.3 million of those synergies have already been captured.

Adjusted EBITDA improved sequentially by nearly $3 million compared to Q3 2022.

Total revenues in Q4 2022 grew 184% YoY to $22.6 million.

Gross margin was 29% in Q4 2022, over 1,100 basis points improvement compared to the same period last year.

Blink closed fiscal year 2022 with a record Q4 and full-year results.

Blink targets 2023 revenues in the range of $100 million to $110 million and gross profit in excess of 30%.

Reliability of Charging Stations

First-generation equipment from various companies, including ChargePoint, Blink's original hardware, General Electric, Siemens, and Schneider, was not up to par due to a lack of understanding of the terrain and the equipment's exposure to elements and conditions.

Blink has had some issues with prior generation equipment and networks before the company acquired them, but they have addressed most of those issues.

DC fast charger operators like EVgo and Electrify Americas have experienced more issues and problems due to the complexity of DC chargers, requiring more maintenance.

Blink is focused on deploying Level 2 charging stations, which have fewer maintenance issues.

Blink is driving continued improvements in the reliability of its network and collaborating with the industry to improve quality across the board.

Capital Allocation

The capital offering raised by Blink was a bridge to get the company to the billions of dollars that will be earmarked for the industry for building facilities, infrastructure deployment, and subsidies.

Blink will use the raised capital to handle the operations and growth of its business, including the deployment of charging stations.

Blink believes that there will be mechanisms for financing capital requirements like new build-outs and facilities, as well as deploying charging stations, with less dilutive capital in the future.

Network Fees and Utilization

Blink has seen an eightfold increase in network fees, which come from selling hardware to third parties and recurring fees for selling energy and other services.

Blink has a well-balanced portfolio of revenue offerings, including strong margins in the service part of the business.

SemaConnect acquisition came with a large network, which contributed to the growth of network revenues in the third and fourth quarters of 2022.

Utilization on Blink's network is trending positively and increasing due to the increasing penetration of EVs in overall vehicle sales.

V2G Opportunity

By owning and operating chargers, the company is able to monetize V2G opportunities when programs allow it.

All new charger designs will be V2G capable, including home, commercial, L2, and DC fast chargers, whether owned and operated or sold.

The company is working with outside companies to figure out how to monetize V2G, and how to provide a solution with the installation of a charger and vehicle.

The goal is to explore and monetize everything possible, including V2G, advertising, and selling electricity to EV owners.

The company sees a land grab opportunity to monetize locations as EVs become more popular, and as they have more hardware and electricity purchasing power.

State and Federal Funding

The company is still waiting for state-level and federal funding programs to be put in place.

Only three states are out with one having gotten responses in and evaluating if they require funding.

The real work is expected to happen in 2024.

Service-Related Offerings

The company aims for a 60-40 split between host and own-and-operate for service-related offerings, but it's difficult to predict the balance between the two.

Businesses and municipalities are realizing they don't want to own and operate chargers and want to outsource it to the company.

The company is seeing a conversion where prior owners and operators want someone else now managing that service for them.

Manufacturing

The company has increased the productivity of the manufacturing facility in Bowie, pushing out almost 14,000 units, and will be moving to a second shift to push output up to 4,000 units per month.

They plan to add more square footage to the manufacturing facility to increase output up to 50,000 chargers per year.

The company plans to manufacture L2 chargers out of the DC fast charger plant as well.

The company has done a product rationalization study and will be moving more to some of the product out of SemaConnect, with the goal of having a lower cost of goods sold, more profit per charger sale, and a greater share of market.

OpEx Trajectory

The company is still examining where operational cost synergies exist and expects to see additional reductions in operational costs globally as they move further into 2023.

As they transition networks, support staff and sub-vendors for the older network will be eliminated, leading to more operational reductions.

Product rationalization study is expected to lead to lower cost of goods sold, more profit per charger sale, and a greater share of market.

The OpEx is expected to continue growing due to other areas of growth.

Reductions have been made in high-end staff due to duplication resulting from merging companies.

Staff in IT and technology will be identified, and manufacturing staff over time and production workers and assemblers will be added.

Revenue Growth and EBITDA Break-Even

The business is growing with an increase in revenues, but a decreasing in the losses.

Targets for EBITDA break-even will be provided later in the year.

Product Sales and Blink-Owned Deployments

About 5,000 units are Blink-owned, and over 50,000 of the network are historical.

Single orders are larger in size than revenues from a few years ago, and the business is very competitive.

Large outside orders put a substantial amount of business in the host-owned.

The company has a variety of models that allow for flexibility and viability, leading to significant growth in size and scale.

Key Takeaways from what was said on the Call:

Global EV sales are growing rapidly, with EVs achieving around 10% market share for the first time, and many OEMs are going electric with their mainstream offerings to achieve scale and price parity with internal combustion engines.

The shift to electric vehicles will not only change the needs for refueling but also put in place the need for new infrastructure required to service and maintain these vehicles.

Blink Charging has seen strong growth in revenue and number of stations contracted, sold, or deployed, and it is the only fully vertically integrated charging company in the United States.

Southeast Asia is a primary target market for Blink's charger, as EV adoption for 2-wheel and 3-wheel vehicles is expected to be 40% to 45% by 2030, requiring flexible charging infrastructure.

Blink offers a wide variety of products and services to meet charging requirements globally, and it is driving continued improvements in the reliability of its network.

The company is focused on monetizing V2G opportunities, exploring and monetizing everything possible, including V2G, advertising, and selling electricity to EV owners, and waiting for state-level and federal funding programs to be put in place.