SOFI's Financial Performance: An In-Depth Analysis of Recent Quarters and Future Prospects

Examining SOFI's Steady Progress and Strategic Direction in the Financial Services Industry

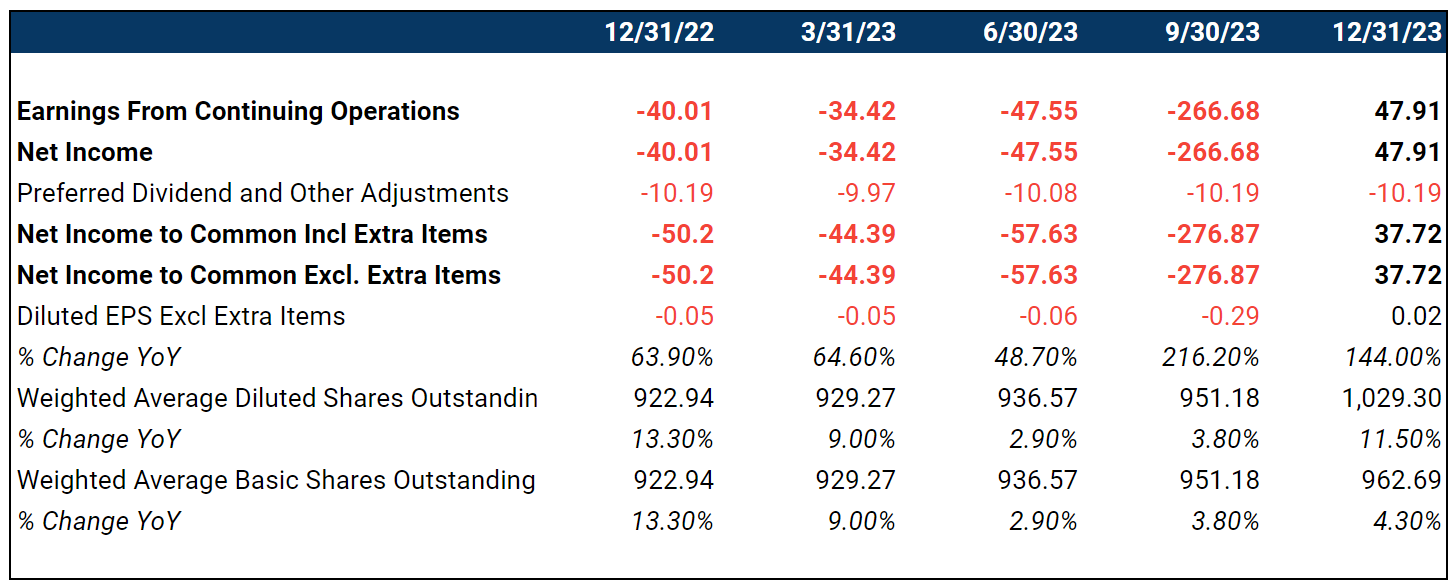

Financial Performance

Q4 2023

Adjusted Net Revenue: $594 million (+34% YoY)

Adjusted EBITDA: $181 million

GAAP Net Income: Achieved profitability

Consolidated EBITDA Margin: 30%

Q3 2023

Adjusted Net Revenue: $531 million (+27% YoY)

Adjusted EBITDA: $98 million

Incremental Margin: 48%

Consolidated Margin: 18%

Q2 2023

Adjusted Net Revenue: $489 million (+37% YoY)

Adjusted EBITDA: Nearly $77 million

GAAP Net Loss: $48 million

Incremental GAAP Net Income Margin: 36%

Q1 2023

Adjusted Net Revenue: $460 million (+43% YoY)

Adjusted EBITDA: Nearly $76 million

GAAP Net Loss: $34 million

Incremental GAAP Net Income Margin: 54%

Q4 2022

Adjusted Net Revenue: $443 million (+58% YoY)

Adjusted EBITDA: $70 million

GAAP Net Loss: $40 million

Incremental GAAP Net Income Margin: 42%

Estimates for Future Quarters:

Keep reading with a 7-day free trial

Subscribe to LongYield to keep reading this post and get 7 days of free access to the full post archives.