Temu's Parent PDD Holdings Posts Double-Digit Sales Growth, Faces Profit Squeeze in Competitive E-Commerce Arena

PDD Holdings Inc. (NASDAQ: PDD), the parent company of Pinduoduo and Temu, reported a 10% year-over-year revenue increase in Q1 2025, reaching RMB 95.7 billion (US$13.184 billion). This growth was driven by a 15% rise in online marketing services revenue to RMB 48.7 billion and a 6% increase in transaction services revenue to RMB 47 billion. However, profitability declined significantly, with operating profit down 38% to RMB 16.1 billion (US$2.217 billion) and net income attributable to ordinary shareholders falling 47% to RMB 16.7 billion (US$2.031 billion). Non-GAAP net income also dropped by 45% to RMB 16.9 billion (US$2.331 billion). The decline in profitability was attributed to increased investments in the company’s ecosystem, including merchant support programs and supply chain enhancements, amid a challenging external environment marked by intensified competition and geopolitical uncertainties. Despite these challenges, PDD maintains a strong balance sheet with RMB 364.5 billion (US$50.3 billion) in cash, cash equivalents, and short-term investments as of March 31, 2025. The company’s strategic focus on long-term sustainability, particularly through ecosystem investments and international expansion via Temu, positions it for potential future growth, though near-term profitability may remain under pressure.

Financial Performance

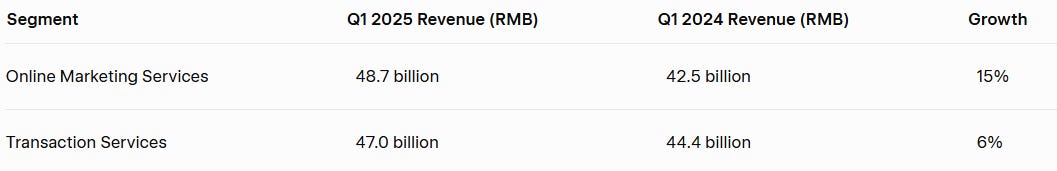

PDD Holdings Inc. delivered total revenues of RMB 95.7 billion (US$13.184 billion) in Q1 2025, marking a 10% increase from RMB 86.8 billion (US$12.0 billion) in Q1 2024. The revenue growth was driven by two core segments:

Online Marketing Services: Revenue increased 15% to RMB 48.7 billion (US$6.714 billion) from RMB 42.5 billion, reflecting strong demand for advertising and promotional services as merchants increasingly rely on PDD’s platforms to reach consumers.

Transaction Services: Revenue grew 6% to RMB 47 billion (US$6.47 billion) from RMB 44.4 billion, though the slower growth rate mayindicate competitive pressures or shifts in consumer behavior toward more value-driven purchases.

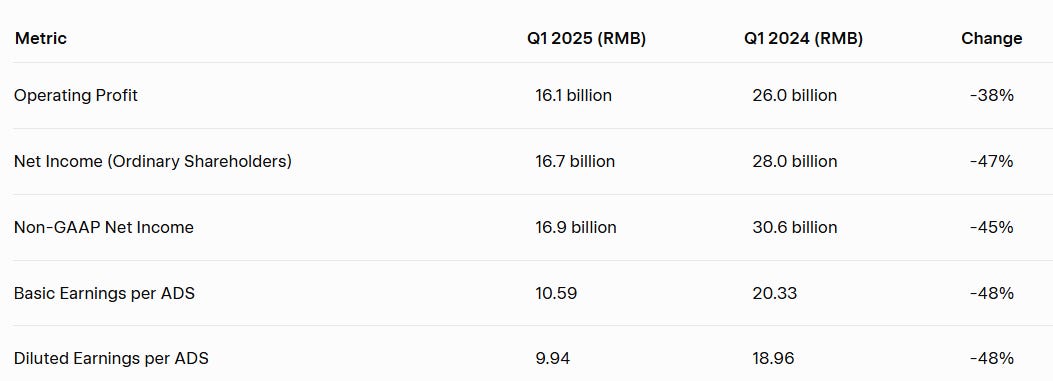

Despite revenue growth, profitability metrics showed significant declines:

The decline in profitability was primarily due to higher operating expenses, particularly in sales and marketing, which rose 43% to RMB 33.4 billion (US$4.6 billion) from RMB 23.4 billion, and research and development, which increased 23% to RMB 3.6 billion (US$0.5 billion) from RMB 2.9 billion. These increases reflect PDD’s strategic investments in its ecosystem to support merchants and enhance long-term competitiveness.

Cash flow also moderated, with net cash provided by operating activities decreasing to RMB 15.5 billion (US$2.138 billion) from RMB 21.1 billion (US$2.90 billion) in Q1 2024. However, the company’s balance sheet remains robust, with cash, cash equivalents, and short-term investments totaling RMB 364.5 billion (US$50.3 billion) as of March 31, 2025, and other non-current assets increasing to RMB 76.2 billion (US$10.5 billion) from RMB 33.6 billion, largely due to deposits and debt securities.

Business Model and Strategic Positioning

PDD Holdings Inc. operates through two primary platforms: Pinduoduo, a leading e-commerce platform in China known for its group-buying model that offers discounted prices to consumers, and Temu, its international e-commerce platform targeting overseas markets. The company’s business model centers on connecting consumers with merchants, particularly small and medium-sized enterprises (SMEs), by providing a platform that facilitates transactions at competitive prices. Revenue is generated through:

Online Marketing Services: Advertising and promotional services for merchants, which accounted for 51% of Q1 2025 revenue.

Transaction Services: Fulfillment and payment processing fees, contributing 49% of revenue.

Strategically, PDD is transitioning from a platform operator to a high-quality e-commerce ecosystem that supports both supply and demand sides. Key initiatives include:

Merchant Support: PDD launched a RMB 10 billion fee reduction program and a RMB 100 billion support program to lower costs and drive sales for merchants, particularly SMEs. The establishment of the Merchant Right Protection Committee further underscores its commitment to a resilient merchant ecosystem.

Supply Chain Enhancement: Investments in high-quality supply chains, including support for agricultural products through the 2025 Duo Duo specialty initiative and visits to manufacturing bases, aim to improve product quality and merchant competitiveness.

Consumer Engagement: Programs like the merchant giveback initiative and consumer coupons, along with direct discount programs benchmarked against national subsidies, are designed to stimulate demand and enhance the shopping experience.

Compared to peers like Alibaba and JD.com, PDD’s competitive advantages include its focus on price-sensitive consumers through value-for-money offerings and its innovative group-buying model. However, as a third-party marketplace, PDD faces challenges in benefiting from policy incentives that favor first-party platforms, which could limit its ability to compete in certain areas.

Tariffs and Geopolitical Risk

PDD Holdings Inc., particularly through Temu, is exposed to risks from U.S.-China trade tensions and potential tariffs. The company has noted that external uncertainties, including tariffs and policy changes, have pressured merchants, necessitating increased ecosystem investments to maintain competitiveness. An escalation in tariffs or regulatory scrutiny could increase the cost of goods sold on Temu and disrupt supply chains, particularly in international markets. To mitigate these risks, PDD is working to stabilize prices and supply globally, supporting local merchants, and fulfilling orders from local warehouses to adapt to policy shifts. Investors should closely monitor developments in U.S.-China trade relations, as new tariff announcements could materially impact Temu’s growth trajectory and PDD’s overall financial performance (PDD Stock Dives).

Segment Performance and Market Trends

While detailed breakdowns by geography or product category were not provided, PDD’s core segments performed as follows:

Online Marketing Services: The 15% revenue growth to RMB 48.7 billion indicates strong merchant demand for advertising, reflecting PDD’s ability to attract merchants despite market challenges.

Transaction Services: The 6% revenue increase to RMB 47 billion suggests slower growth, potentially due to intensified competition or shifts in consumer behavior toward value-driven purchases.

Market trends in China’s e-commerce sector show continued growth, albeit at a moderating pace. PDD’s focus on value-for-money offerings positions it well to capture market share among price-sensitive consumers. However, the company faces intensified competition from established players like Alibaba and JD.com, as well as new entrants. Consumer behavior is shifting toward greater emphasis on quality and brand recognition, presenting both opportunities and challenges for PDD as it upgrades its merchant ecosystem and supply chain (PDD Q1 2025 Highlights).

Capital Allocation and Balance Sheet

PDD Holdings Inc. maintains a strong balance sheet, with cash, cash equivalents, and short-term investments totaling RMB 364.5 billion (US$50.3 billion) as of March 31, 2025. This substantial cash reserve provides significant flexibility for capital allocation. The company is prioritizing reinvestment in its ecosystem, as evidenced by increased operating expenses in sales and marketing (RMB 33.4 billion) and research and development (RMB 3.6 billion). These investments aim to support merchants and enhance platform competitiveness.

There is no mention of share buybacks or dividends, suggesting that management is focusing on long-term growth over short-term shareholder returns. The balance sheet is healthy, with no significant debt levels reported, further strengthening PDD’s financial flexibility.

Recent News and Notable Developments

As of May 28, 2025, there are no significant developments beyond the Q1 2025 earnings release on May 27, 2025 (PDD Q1 2025 Results). The market reacted negatively to the earnings miss, with PDD’s stock price dropping approximately 14% on May 27, 2025 (PDD Stock Sinks). Key initiatives announced include:

A RMB 100 billion merchant support program to lower fees and drive sales.

The establishment of the Merchant Right Protection Committee to foster a resilient merchant ecosystem.

No management changes, new market entries, or legal challenges were reported, but investors should remain vigilant for such events, as they could impact PDD’s valuation and market perception.

Outlook and Analyst Commentary

PDD Holdings Inc. expects near-term challenges due to sustained ecosystem investments and an uncertain external environment. The company emphasizes long-term intrinsic value over short-term financial performance, indicating that profitability may remain under pressure as it continues to support merchants and consumers. Key risks include:

Geopolitical Tensions: Escalation of U.S.-China trade tensions and tariffs could impact Temu’s operations and supply chain (Temu Profit Dives).

Competition: Intensified competition in domestic and international e-commerce markets.

Regulatory Changes: Potential policy shifts affecting PDD’s business model.

Potential catalysts include:

Temu’s Growth: Continued expansion in international markets, if geopolitical challenges are navigated successfully.

Macroeconomic Stabilization: Improved consumer sentiment and spending could boost demand.

Ecosystem Investments: Successful execution of merchant and supply chain initiatives could strengthen platform competitiveness.

Analyst commentary reflects concern over the Q1 2025 earnings miss, with the stock price drop indicating investor caution. However, some analysts may view PDD’s long-term strategy positively, particularly if it leads to sustainable growth. The company’s strong cash position and strategic focus provide a foundation for future opportunities, though investors should approach with cautious optimism given the near-term challenges.