Carvana: Disrupting the Car Buying Process but might dilute you in the process

Will they stop tapping the market for funds anytime soon?

Update: Since the original publication of this article we have also published our analysis on their Q2 earnings, you can read that here: Carvana: Q2 Earnings

Carvana was founded by Ernest Garcia III, Ryan Keeton and Ben Huston in 2012. Founded to make car buying easy. Car dealerships are a pain and almost no one likes it, Carvana was founded to fix this issue. Carvana was created as a subsidiary of ‘’Drivetime’’ a company that is also in the business of selling used cars and a company that is led by Ernest Garcia II.

Another pandemic ‘’darling’’ that has come down dramatically since the end of the pandemic and the pop of the memestock bubble. Carvana made a high of $376 in 2021 and is currently trading at $25 per share loosing 93% of its value (Current Valuation $4.7b)

The company is trying something similar to what Opendoor is doing, they are trying to take an analog business online. But is it going as well as it is going for Opendoor?

Business Model:

Revenue Streams:

Used Vehicle Sales : Used vehicle sales represent the aggregate sales of used vehicles to customers through their website. Revenue from used vehicles sales is recognized upon delivery to the customer or pick up of the vehicle by the customer

Wholesale Vehicle Sales: Wholesale vehicle sales is equal to the aggregate proceeds they receive on vehicles sold to wholesalers. The vehicles they sell to wholesalers are primarily acquired from customers who sell a vehicle to them without purchasing a retail vehicle and from their customers who trade-in their existing vehicles when making a purchase from them

Loan Sales: Revenues generated through the sales of loans they originate and sell in securitization transactions or to financing partners. The more transactions they made (the more cars they sale financed) the higher the revenue from ‘’Loan Sales’’

VSC and GAP: Carvana receives commissions on VSCs and sales of GAP waiver coverage

Operational Model

Vehicle Acquisition:

Vehicles directly from customers, that could be a customer that sells and does not buy a new one, or could also be in the way of a trade in when buying another vehicle from Carvana.

Auctions: Through auctions of vehicles done by players like Mannheim, Adesa (which they are now acquiring for $2.2 billion), Smart Auction

Off Lease/ Off Rental: Acquisition of vehicles getting out of leases or vehicles coming off the rotation of rental companies like Hertz, Enterprise.

Screening:

To screen the vehicles to be purchased they use different sources of data. From basic things like year and model to data available online like vehicle information on Carfax, Kelly Blue book, Autotrader, Carvana’s own historical data, etc.

Inspection and reconditioning

Once the vehicles are acquired they go for inspection and reconditioning. At the end of Q1 2022 they had 17 inspection and recondition centers (IRCs) and a total capacity of processing ~1m vehicles at full annual capacity.

Photography and Annotation:

Vehicles go for 360 degree photography that enables interactive interior and exterior tours. Afterwards these are available on the website for customers to better appreciate each vehicle.

Logistics and Fulfillment:

Delivery of vehicles are done in two main ways, through what they call ‘’vending machines’’ and home delivery.

Key Metrics / Performance

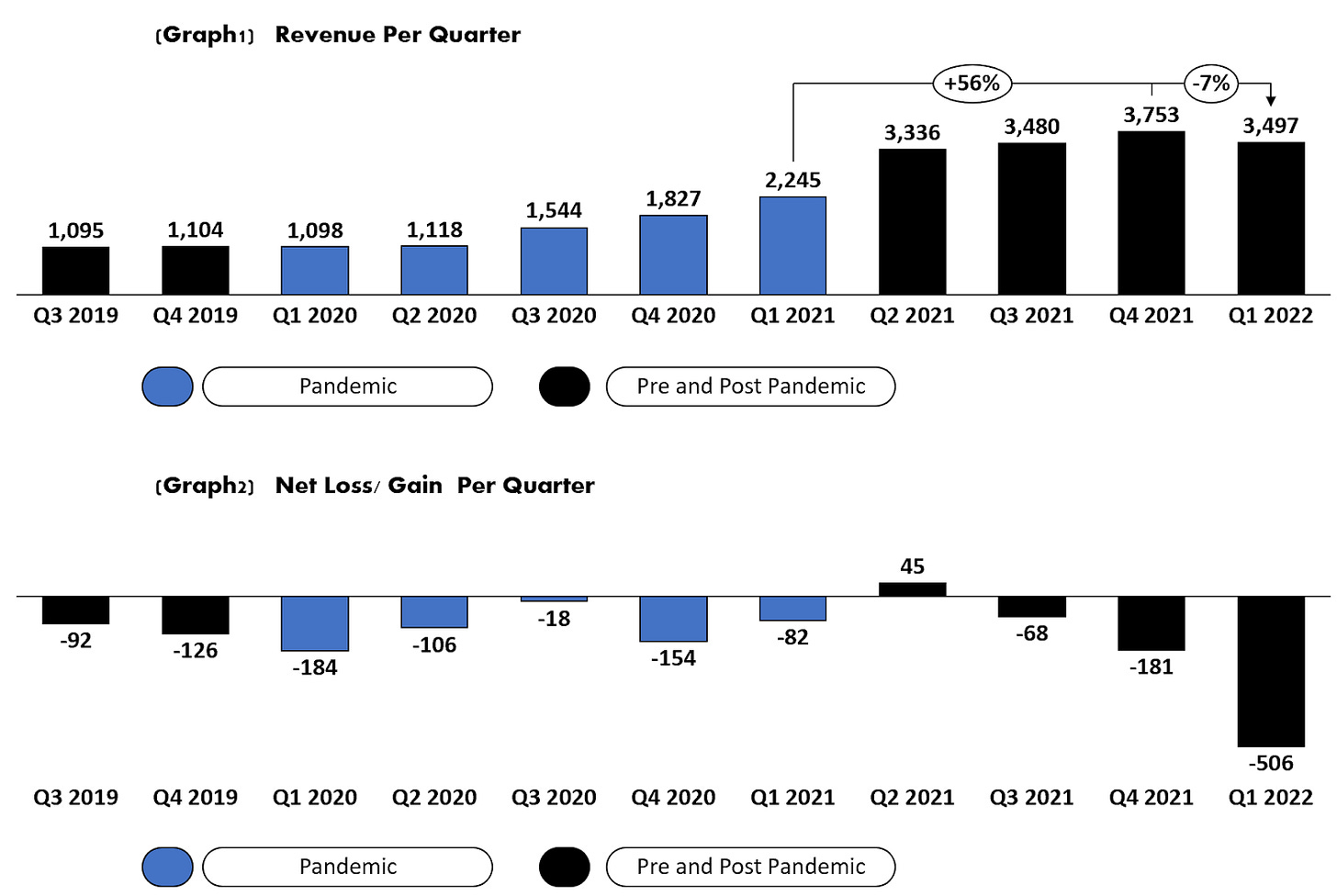

Being another company that has seen a lot of volatile movement through the pandemic it is important to see the company quarter by quarter.

Revenue took a dip in Q1 2022 dropping 7% vs Q4 2021

Revenue grew by 56% in Q1 2022 YoY

The have an accumulated net loss in their last 4 quarters of $710m

They have had only one profitable quarter in their history and was recently in Q2 2021, in the middle of the pandemic and as shortage and price increases of used vehicles we at critical levels.

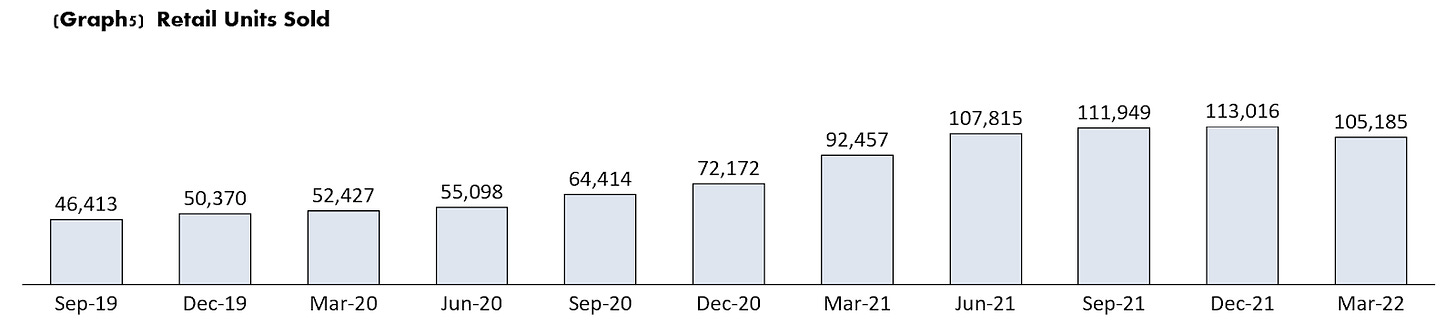

They sold 425K retail vehicles in 2021 and 105K in Q1 2022

Revenue has been growing a lot for the last year and half, but one thing that jumps out as well is the more revenue grows the more money is lost in the quarter (with a few exceptions). Not only has it grown larger and larger, Q 1 2021 was a considerably higher loss ($506m) You have to add up the last 6 quarters to get even close to that amount lost in Q1 2021.

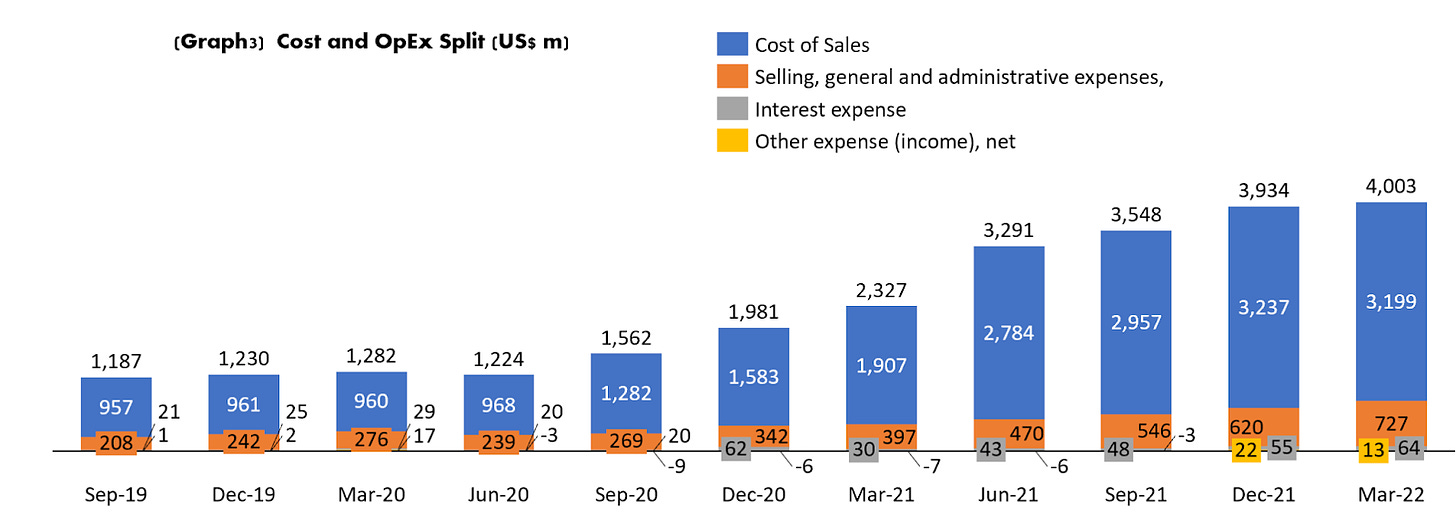

This should be a business that gets better results with scale, since they are having a lot more vehicles sold we will have a look in detail at their cost and opex to better understand where the money is being spent.

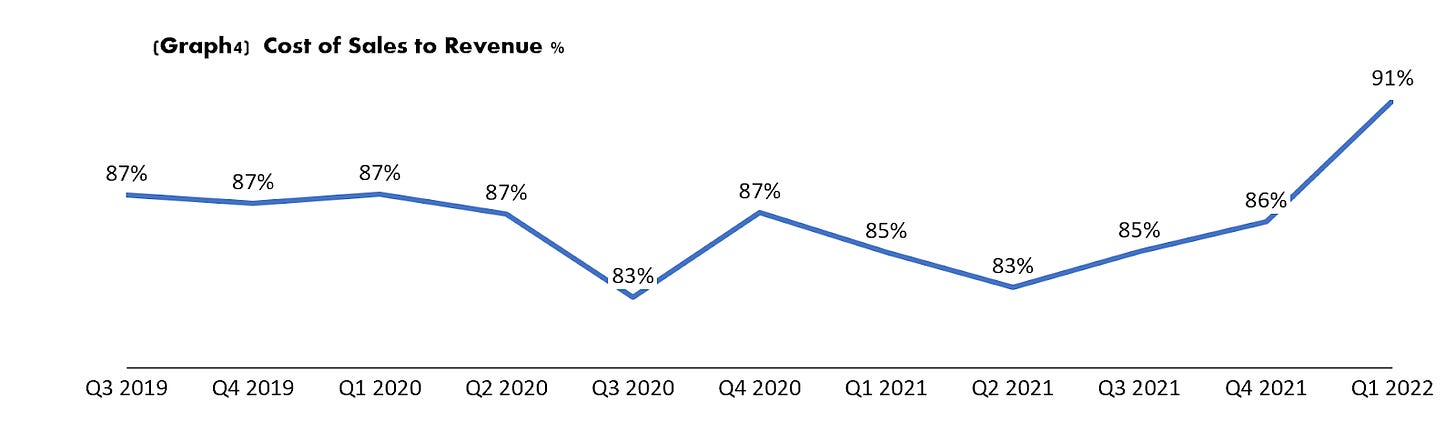

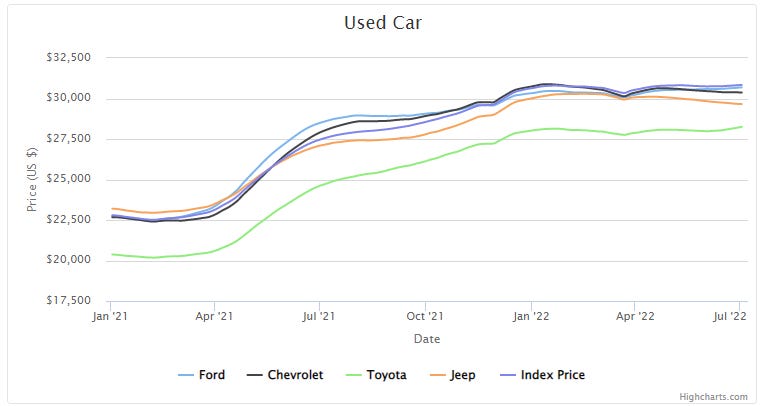

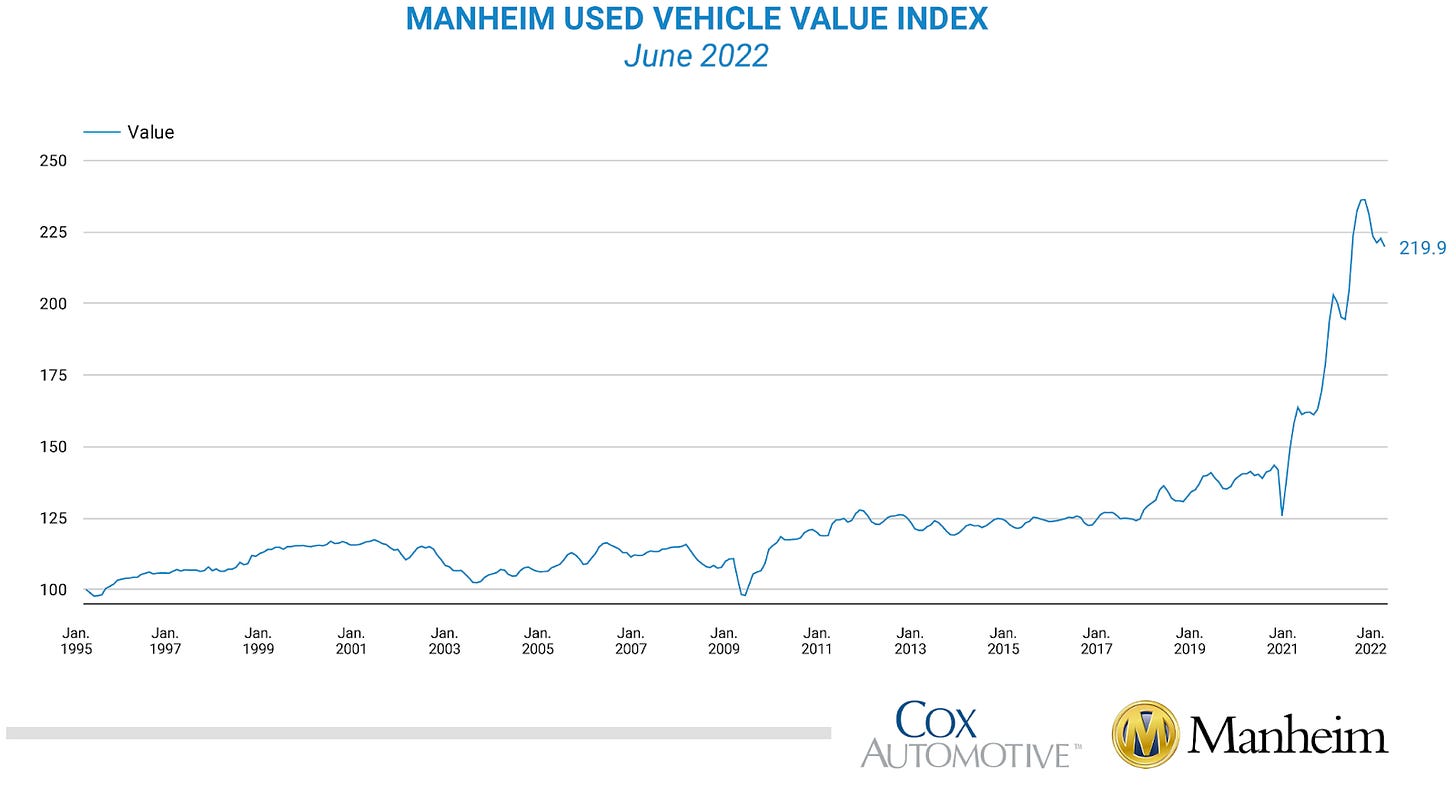

Cost of sales is the first thing that has gone up significantly. It has gone from about 86% to 91% in Q1 2022. Q2 2021 has been the only profitable quarter for the company, also had the lowest cost of sales at 83%. It happens to match with the quarter that used car prices skyrocketed as seen in the picture below from Cargurus (going from an average $22.9K at the end of March to $27K at the end of Q2 2021, up 18%). Prices were constantly going up throughout all Q2 2021 their inventory at that time was purchased with lower prices giving them their best cost of sale to date.

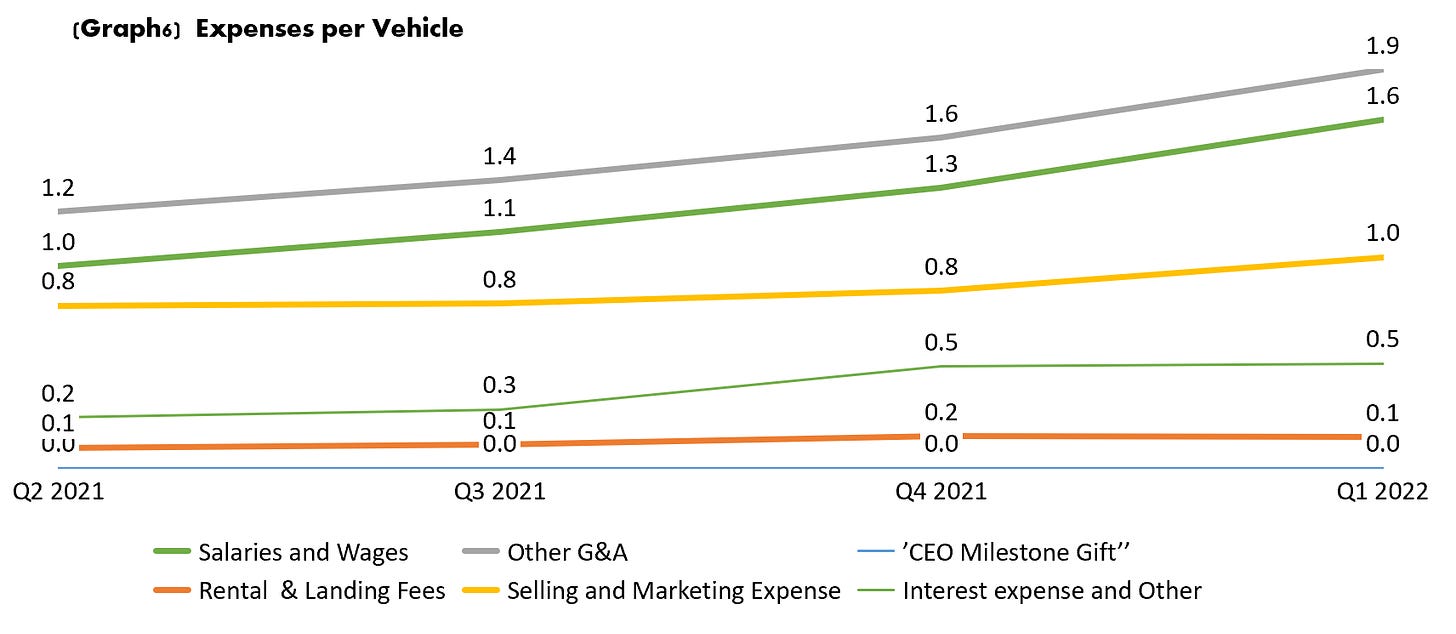

Looking at the cost expenses per unit and revenue per unit, costs are accelerating faster than revenues per unit.

Revenue per unit has been stable, this goes in line with how stable the average used car price has been in the last quarters as seen above

Cost per Unit continues to grow, so they are still paying more each quarter on average to acquire vehicles but the same growth has not been reflected in revenue

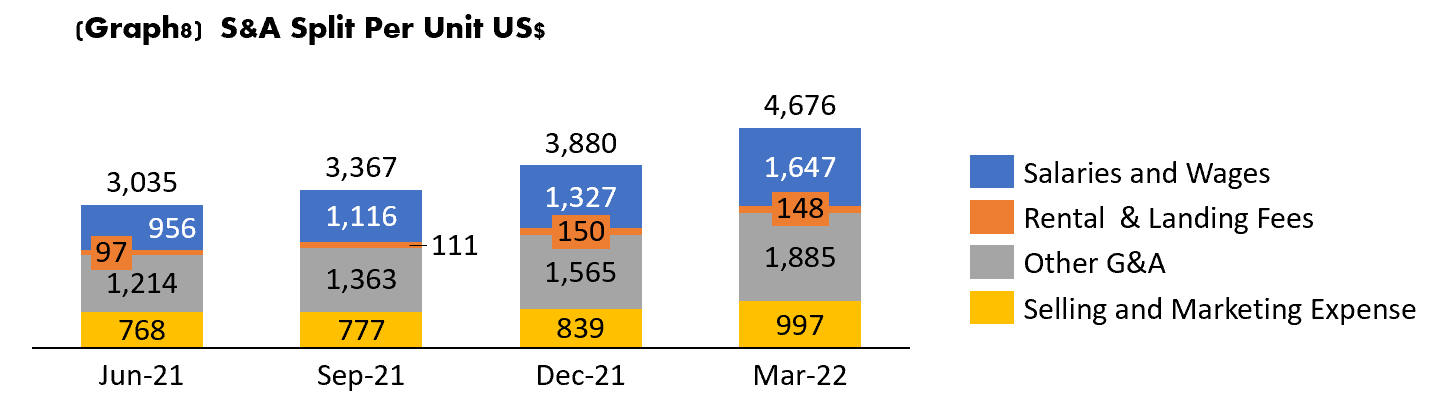

Sales, Marketing and administration is the one growing the most. It has grown by 1.25X from Q2 2021. The trend for the past 3 quarters is established and higher.

Carvana explained the higher cost per vehicle in their letter to shareholders with this statement:

‘’We generally prepare for sales volume 6-12 months in advance, meaning we built capacity in most of our business functions for significantly more volume than we fulfilled in Q1. With our costs relatively fixed in the short-term, the lower retail unit volume led to higher cost of goods sold per unit (e.g., reconditioning and inbound transport costs), leading to lower GPU, and higher SG&A per unit. These effects combined with rapidly rising interest rates and widening credit spreads led to lower EBITDA margin’’

Cost and SG&A must be followed for the next quarters. These have been trending higher since Q3 2021, it has not been a one quarter thing.

Q1 2022 has been their worst quarter in the last 11 in terms of net income per unit sold. They lost close to $3K per vehicle during this quarter. When looking at SG&A in more detail we see that the line growing the fastest is Salaries and Wages, which rose by 72% per unit and ‘’Other G&A’’ which rose by 55%.

So far the company has not been able to scale their business, the trend we saw in Q2 has to change quickly. If the high loss per vehicle is repeated in the future the company will accelerate its net loss, given the growth in transactions each month. More transactions could be a bad thing and not a good one if they can’t control their loss per vehicle. This will accelerate their need for cash and might accelerate the need for tapping either the capital markets or raising more debt.

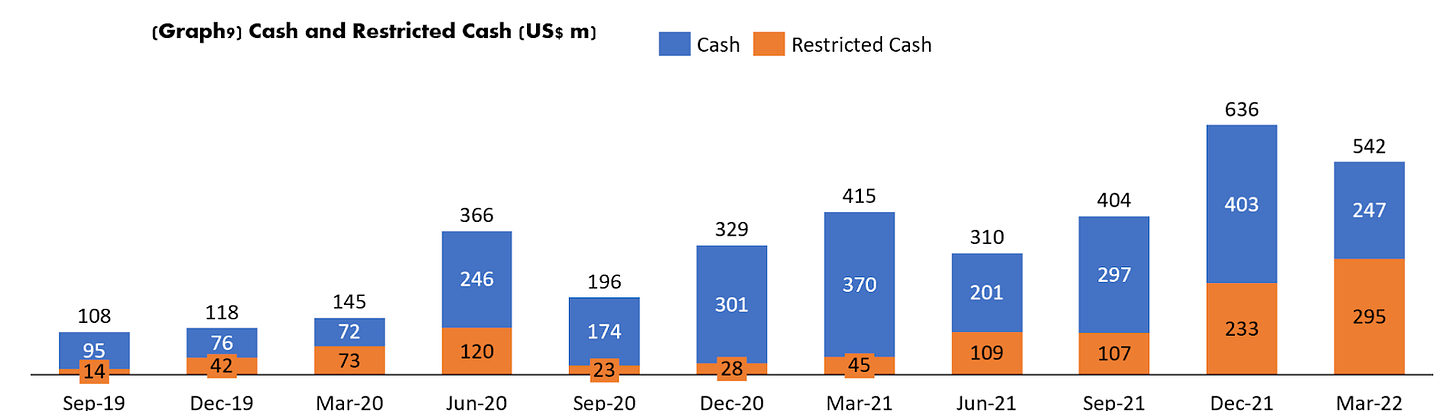

Balance Sheet

Carvana currently holds $247m in cash (end of Q1 2022) and $295 of restricted cash, for a total of $542m. Given recent losses we will have a closer look at what has been the trend of their cash holdings for the past few quarters.

Their cash holdings have remained stable in their most recent quarters which suggests that they have been getting outside funding given that large losses amounting to $710M in the last 12 months.

From their latest 10Q filing we get some detail on how they are getting financing for these losses:

‘’The Company has incurred losses from inception through March 31, 2021’’

“Since March 31, 2020, the Company has completed equity offerings of approximately 18 million shares of Class A common stock for net proceeds of approximately $1.1 billion and has issued a total of $1.7 billion in senior unsecured notes due between 2025 and 2028, from which approximately $627 million of the proceeds were used to repay its senior unsecured notes due in 2023. As of March 2021, the Company's forward flow partner has also committed to purchase a total of $4 billion of the Company's finance receivables through March 2022. In addition, the Company has a $1.25 billion floor plan facility effective through March 31, 2023. Management believes that current working capital, results of operations, and existing financing arrangements are sufficient to fund operations for at least one year from the financial statement issuance date.’’

From the statement above we can summarize very important facts:

They have enough liquidity to fund operations for one year

They have been issuing a lot of shares recently

In their recent earning call they also added that Carvana will be raising the following funds:

$2.275b in unsecured notes for the acquisition of Adesa US

$1b in preferred equity and $1b in common equity for future real estate improvement (mostly for improvements of Adesa infrastructure) and general corporate purposes.

As of March 31st the company had $1.7b in available liquidity in cash, revolving availability and financeable real estate and securities

From funding to be done in the coming months it is expected that will result in $1.9b of net cash proceeds (after acquisition of Adesa) and $900m of financeable real estate

Total liquidity available at the end will be $4.5b. This includes everything, from revolving availability to refinanceable real estate to cash, etc.

Apart from the rising debt, dilution might be one of the things that might interest current and future shareholders the most. With about $2b being raised shareholders will be dramatically diluted.

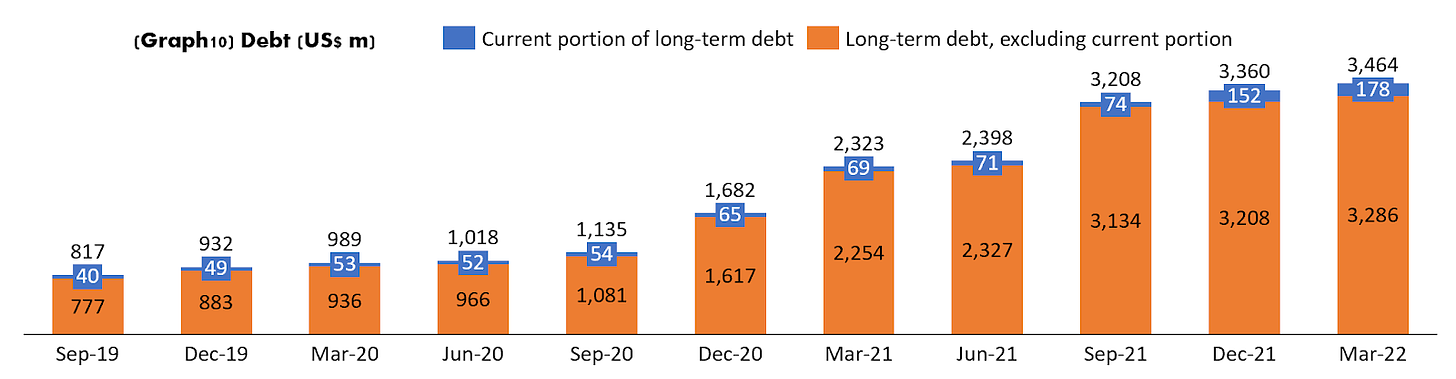

Long and Current debt has been relatively stable for the past 3 quarters. But as announced it is about to go up by $2.275b to acquire Adesa.

Yet similar to Opendoor, they carry a lot of inventory that is close to the amount of debt they currently hold. At the close of March, they held $3.3b in vehicle inventory. The only difference with Opendoor is that this inventory is more volatile and actually depreciates in value.

Other

Capex is an additional expense that has been growing and adds to the need for liquidity. Last 12 month has been $695m and in 2021 $557m

Competitive Landscape

Used car sales is a highly fragmented industry, Carvana indicates that there are more than 43K used car dealerships in the US. We will focus on some of their bigger competitors. Vroom and Carmax. Vroom is their biggest competitor in terms of business model and Carmax is one of the biggest legacy players in used car sales

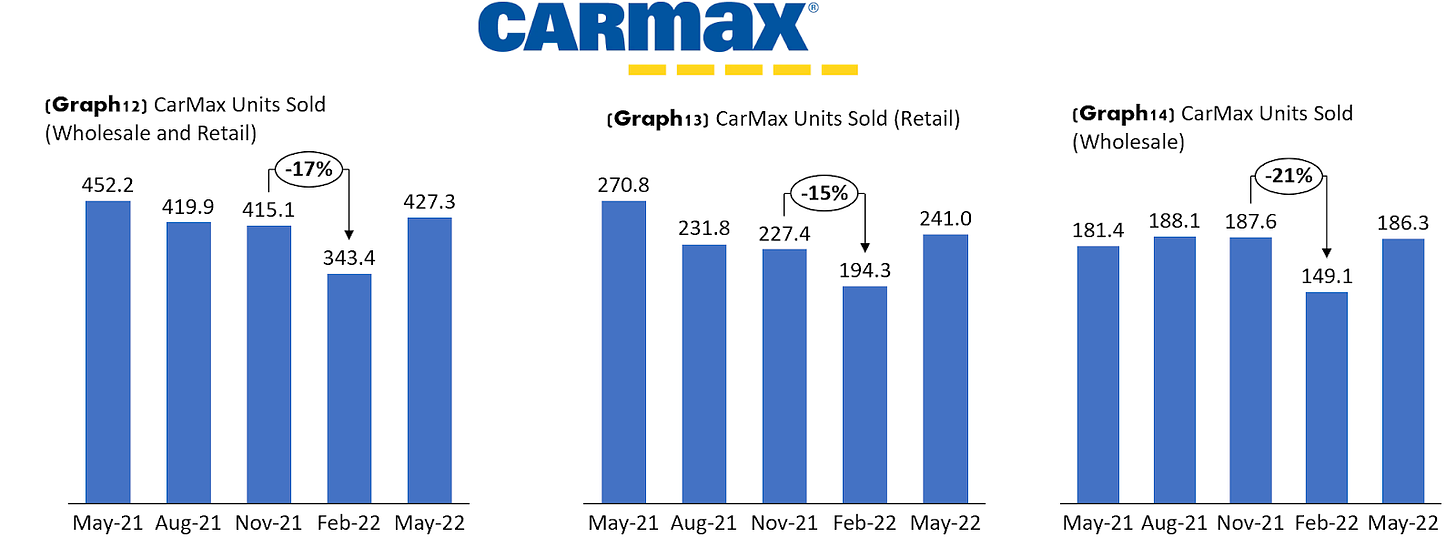

First quarter or the first few months of the year were also down quarters for Vroom and Carmax, confirming that the used cars market had an impact in early 2022. Carmax has a different fiscal year and has reported already on retail sales for the period between Feb 2022 and May 2022. A rebound could perhaps be expected in Carvana. It is surprising to see that Carmax had an increase while loan rates have increased significantly in recent months. Perhaps it has an impact from tax season.

When looking at new car sales in the US, there was no drop in sales. The number of cars sold went up by 2% and has stayed stable during Q2 2022.

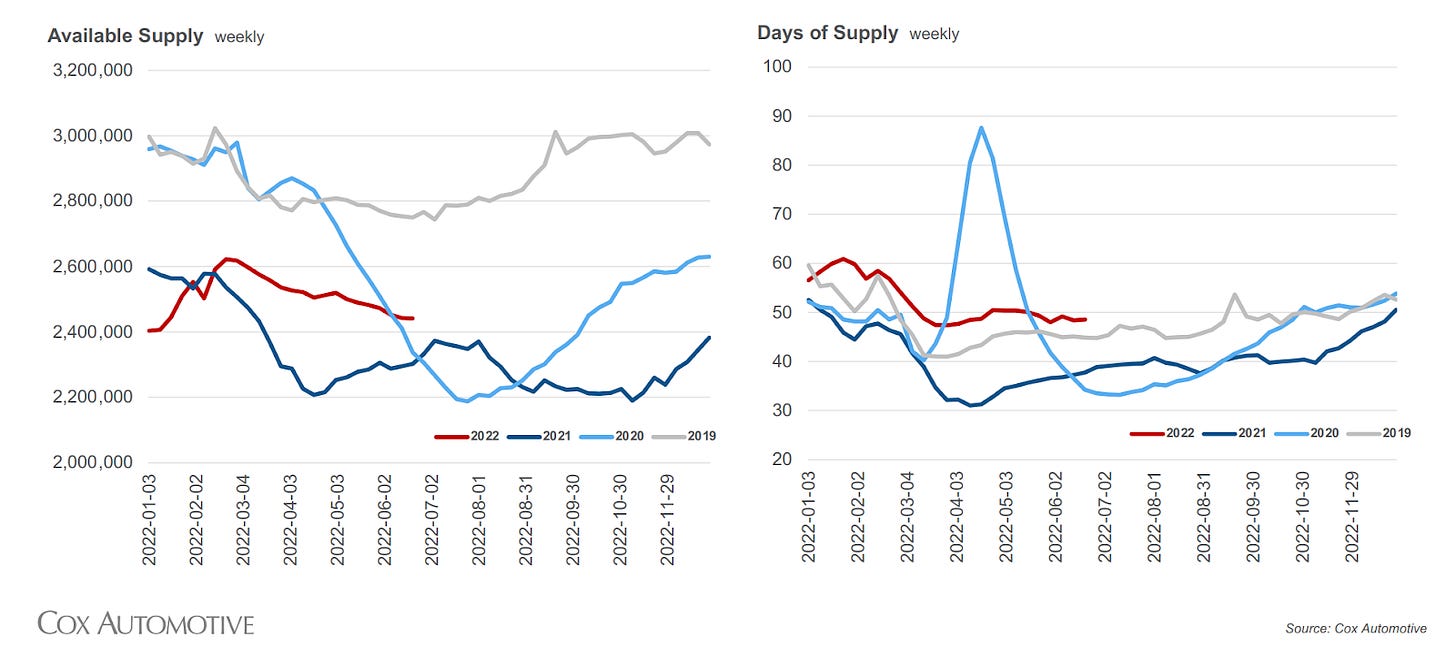

What we see from information released by Cox Automotive is that the supply during Q1 was higher than it had been in recent months. So it seems that it was indeed an industry wide slowdown in Q1. If you look closely in the image below. The rise in supply started rising from about October 2021 and peaked in March 2022, it has come down slowly since, but is still higher than most of the supply available during 2021.

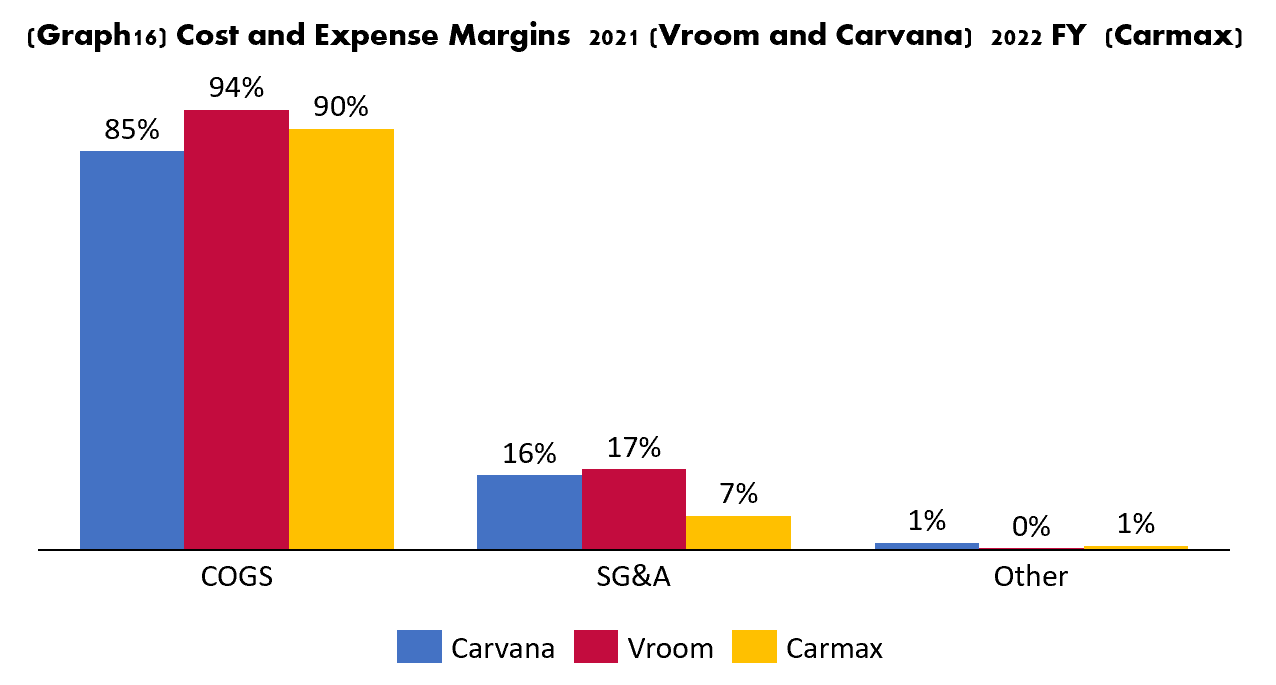

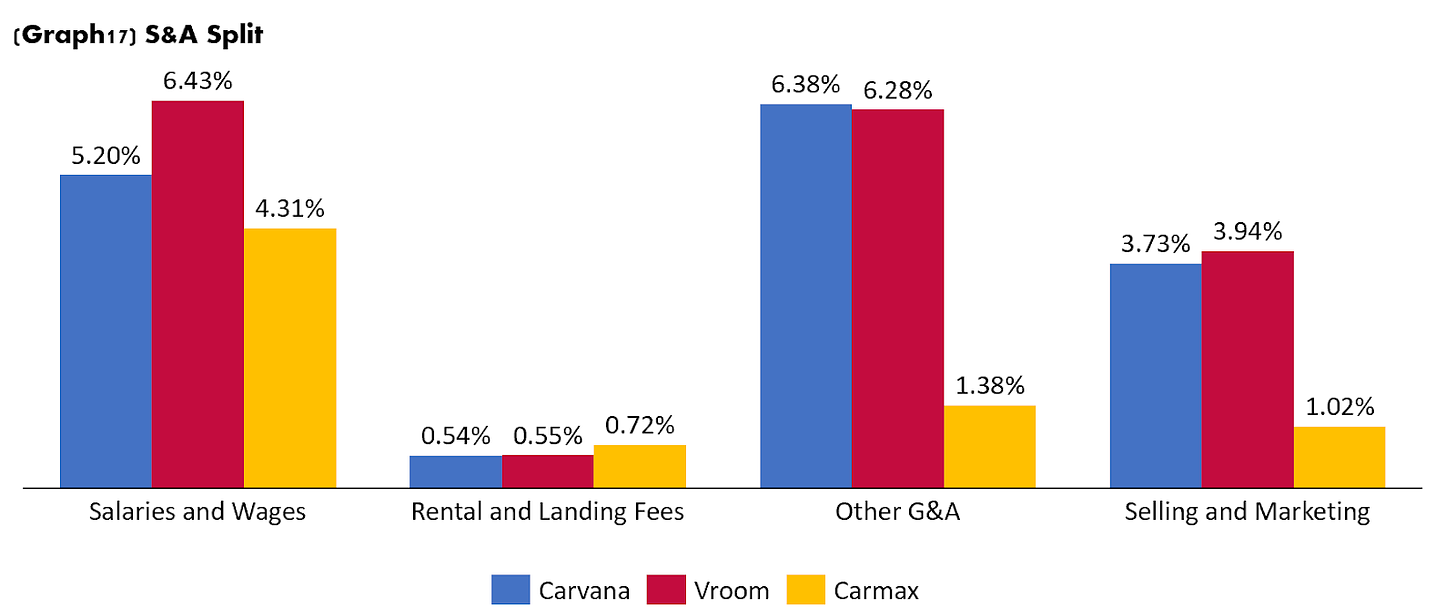

In terms of profitability, Vroom and Carvana are at similar stages of maturity. Both companies are currently losing money, while Carmax is profitable. But in terms of who has better margins (between Carvana and Vroom), Carvana currently leads with 900bps better cost of sales than Vroom. In terms of SG&A they are very close, one thing worth noticing is that Carmax had a COGS margin of 90% in their latest fiscal year. Higher than the one seen in Carvana, where Carmax is a lot more efficient is SG&A level, they held at 7%, a lot better than Carvana or Vroom. Carmax has been deteriorating their COGS margin lately. They went from 86% in 2020 to 90% in 2022

Clearly for both Vroom and Carvana their main issue is SG&A. Carvana in their presentation shows that their long term target for SG&A is between 6% to 8%, that is right where Carmax is currently operating at.

The big difference between the three companies lies in ‘’Other G&A’’ and S&M. These two have to be improved in order to get to a profitable structure.

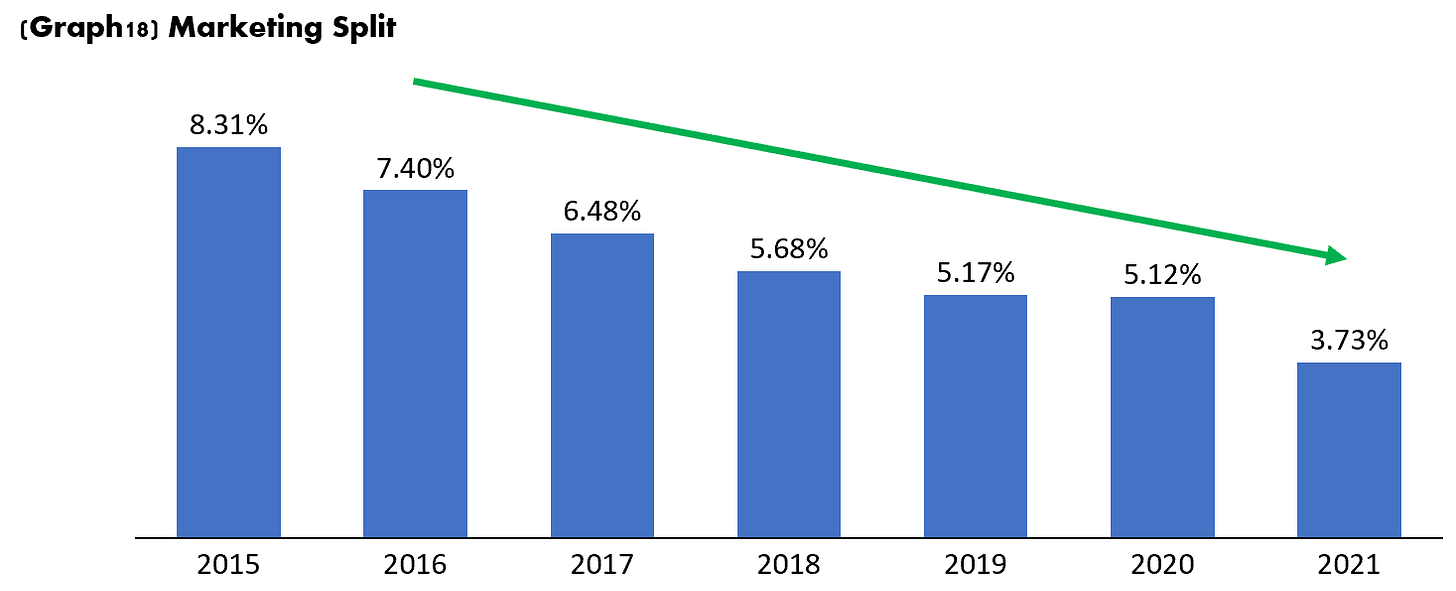

Looking at the past few years for Carvana, they have made a lot of progress in terms of Selling and Marketing. The improvement comes from scale, the more revenue they get, the better their margin will be. It perhaps needs a couple of years to reach closer to the values that Carmax holds

The largest cost that is still very high as a percentage of revenue is Other G&A. This line includes Logistics, IT expenses, corporate occupancy, professional services and insurance, limited warranty, and title and registration. You can see better scale here as well, but this remains extremely high, more than 4 times what Carmax have, as their revenue rises this will drop as a percentage of revenue. But how many years until it goes down to Carmax’s level?. Let’s do a very quick calculation, let’s say they stay at $817m spent for ‘’Other G&A’’, the revenue needed to bring down the percentage would be $59b. It would be better to expect a reduction of the level of spending on this line than revenue hitting $59b

Car Market:

Used car market is starting to show signs of finally better affordability, yet prices are still very high. From the latest Manheim Used Vehicle Value index we can see that it has come down, but it is still about 60% above pre pre-pandemic trend.

Once the market normalizes the prices will likely come down quickly though and perhaps we are just getting close to that. There have recently been many articles on an increase in repossession and supply of used vehicles . For example, on a recent article from Barrons, we have the following statement:

“ But based on what he says he has seen (Lucky Lopez) from banks, subprime repos have nearly doubled since 2020, to around 11% on average. The bigger red flag is in prime repos, where borrowers have higher credit scores. Lopez says usually about 2% of prime loans wind up repossessed. Now, that rate is at about 4%”

“Now, he says he has never seen so many people making $2,500 a month owing $1,000 a month in car payments. That’s about double the maximum portion of income many financial advisors recommend allocating toward a car payment.”

This is anecdotal information, but it is important to keep track of official data coming in the next few months.

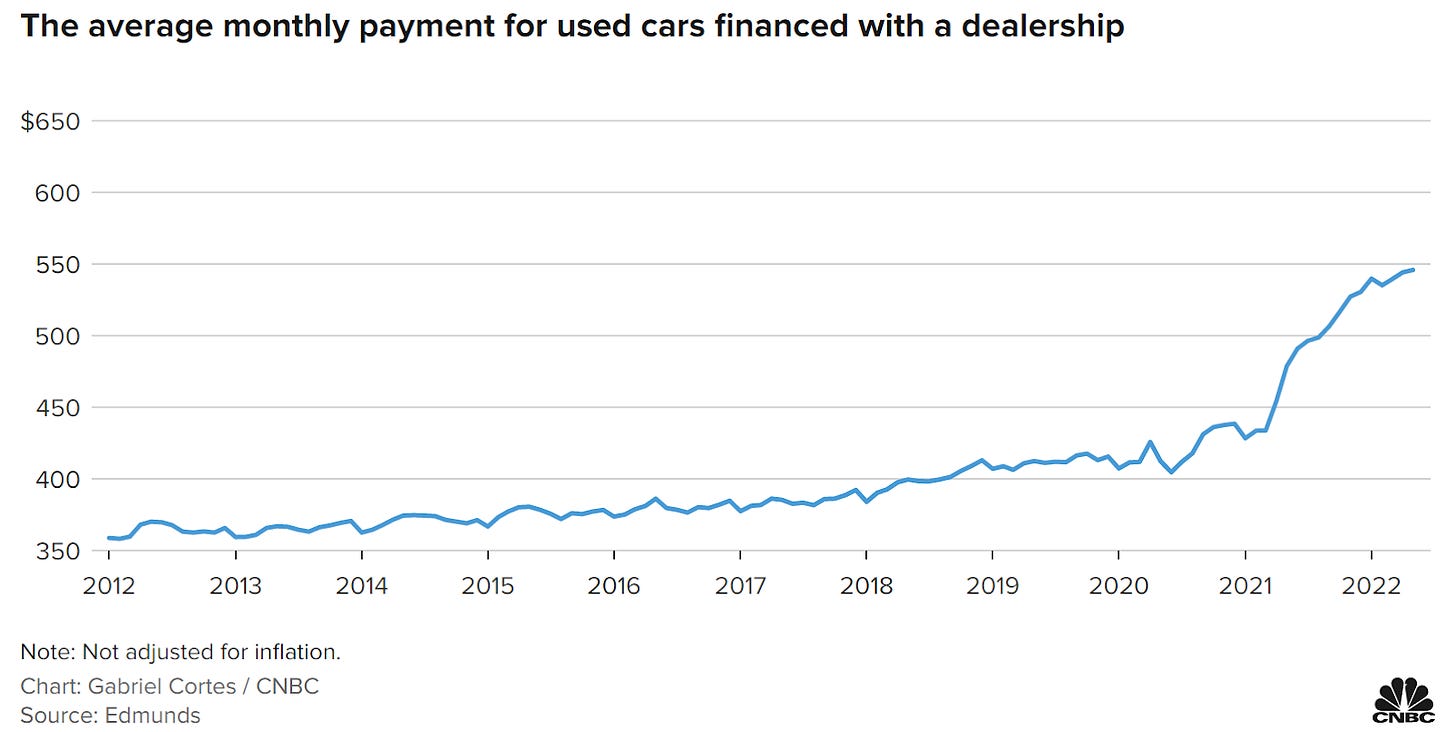

Used car payments have skyrocketed, the average monthly payment to finance at a dealership for used cars has gone from $411 pre pandemic to $546 (average rate of 8.2% and loan length of 70.8 months) Average rates are not coming down any time soon, considering the high inflation, the movements from the Fed and the level that the current 10 year Yield holds. So this will likely bring a big slowdown in sales for the second half of 2022

Some of the possible risks for the company are:

Cash: They are still having big losses each year. Every time they raise more funds via stock offerings they will bring dilution for current stockholders, and if they don’t get profitable soon, there is no guarantee that they will not continue to tap the markets for funding.

Market conditions: We could be close to a new downtrend in the car market. This could have an impact on the speed at which they grow their revenue. Already last quarter they had a slowdown versus Q1 2021. If they don’t continue to grow fast, the much needed scale to be profitable won’t come and will lose money for more years than expected.

Bad Publicity: Recently there have been many articles online focused mainly on slow title processing. They have made many mistakes with some customers in regards to how fast their title is transferred to them. Just last year they received a 180 days ban in North Carolina, the DMV accused Carvana of breaking the state's rules for car dealerships in Raleigh after a customer complained. The DMV accused the company of "failing to deliver titles to DMV, selling a motor vehicle without a state inspection, and issuing out-of-state temporary tags/plates for a vehicle sold to a person in NC,"

Lower Revenue per Unit expected: Price per unit will come down fast eventually as we adjust back to pre pandemic levels. But it is important to track how variable SG&A reacts. If the drop is not reciprocated in the sale proportion at SG&A level, their margins will suffer

Competition: Vroom is already there and Carmax is starting to move into the digital market. Branding and customer service will make a huge difference, so they have to clean all the operational issues fast

Current Inventory: they had about $3b in inventory at the end of Q1. It could be good to start lowering inventory a little for now. If a big drop in prices comes, the value would drop with it. Unlike homes, this is a depreciating asset and prices will likely get back to trend. Current avg. prices are about $30K, if they go down to $25K, that would translate in a drop of about 17% in value

What could be the case for Carvana being a good opportunity for the next 10 years?

Big Market: similar to Opendoor, the market currently is mainly analog, and as the leader on the digital side they can gain a lot of market share and grow revenue considerably. But this again has to be done with great operational efficiency. They currently cover 81% of the US market, but they have not reached a market share above 3.5% in any market and 214 markets are still below 1% penetration. (The used CAR market in 2019 was $840b)

Market Maker: they too can play a market maker role. Loan sales are a side of the business with huge margins. The more cars they sell, the more loan transactions they can have.

Brand awareness: currently they are the “go to guy” to buy a car online

Dealerships: we have to be honest, everyone hates going to a car dealership and having to go through haggling etc. They new trend to buy online is here to stay

Valuation

Carvana currently trades at $25.09 per share or $4.56b. At the end of Q1 they had 90m shares outstanding, currently they hold 105m, this was announced in April of this year. The question will be when will be the next time they will try to get funding from the markets again. They have done it many times and they will likely have to do it again unless they become profitable fast.

DCF analysis for Carvana is not the best tool for this type of company since they have not been profitable since their start and it is unclear when they will make money. Yet we calculated a base case and resulted in a valuation of about $18 per share. This considers some scalability in the next few years. If they don’t find that scale it will be worse. The optimist case gives us a valuation of $50 per share, but a lot of things have to go well and fast for that to happen. Pessimistic $0 or acquired

There are other ways to have a look at their valuation going with the multiple route.

First, let's see what it is implied in their current valuation using Carmax valuation. Carmax currently is valued at $14.8b or 15 times earnings. This would be $304m earnings or about $15b if they become profitable at current Carmax level of earnings. So in terms of revenue they are close, but far on the profitable side. So they are not really worth $4b, not worth the premium with the risk of being diluted in the future.

Second we could have a look at what their valuation would be with Wall Street revenue estimates for 2023. Average estimate for 2023 is $20b if they would be profitable (which likely they won’t) their potential is about $6 billion.

One last approach is to have a look at its long term potential if everything goes right. Meaning they manage to have cash for all the years necessary to reach the necessary scale to become profitable and also they use close to 100% of their future capacity. Their long term capacity is 3.2m in terms of vehicle processing. This could translate into a long term potential valuation of about $30b to $40b if we follow Carmax margins. Up to $60b if we follow their long term targets.

The drop in value for Carmax is justified. This company was not correctly valued in 2021 and likely is a wait and see type of stock. They are about to go through a tough environment if a recession is confirmed soon. That will be an enormous test to know whether it will hold well with the amount of cash they have and if they are flexible enough to hold and improve the scaling of their business. They will likely need to tap the markets for funding, the question is whether they will continue to be funded or might get acquired eventually by a cash rich company that can actually scale the business and have the resources to fund the operations. Their main issue is scale and time to get to that scale.

I think your dilution calc is way off. You are not factoring in the conversion of LLC Units for Class A shares over time. Dilution based on a fully diluted Class A share count since they listed is ~27%, not ~500%......

Check out https://www.the10thmanbb.com/investment-ideas/cvnanyse.